Pinfare? I'm out, and I'm not sorry.

The core value Pinfare offers to air travellers is a way to protect themselves against the fluctuation of air fare prices by paying a fee to lock in the current prices for up to seven days.

Firstly, a disclaimer - I am evaluating this pitch from a perspective of a venture capitalist looking to invest in promising startups.

So on that note, I have identified these as the most important points in my assessment on whether it would be a viable investment for me.

- High barrier to entry because the business model requires high capital (s8)

- Purported large global commercial potential of “3.8 billion air travellers” (s15)

- Pinfare’s “secret sauce” - Very low probability of a price hike in seven days (s16)

- Potential similar applications of Pinfare’s price hedging business model (s17)

- Why can’t airlines just copy their service? (s9)

High capital required

According to the presenters, high capital is required to fund the price hedging business model. I fundamentally disagree with this.

Air fares are not a big ticket item. They are not like your traditional medical or accident insurance where your payouts can even be in the seven figures.

Furthermore, Pinfare’s customers are *paying the hedging fee upfront.* It is not like traditional insurance where the payment terms are monthly or even annually. Hence, the amount of capital you need to have on hand to pay off claims is not high. *On the contrary, it is low!*

Furthermore, just how much can the air fare really fluctuate in seven days?

Which brings us to the next point.

Pinfare’s “secret sauce”

According to the presenters, there is a very low probability of a price hike in the seven day period their air travellers are insured.

This goes against the presenters’ claim that “high capital is required”.

Having a low probability of a price hike also *puts in jeopardy Pinfare’s business model* - if Pinfare’s customers do not experience the pain of their airfare fluctuating frequently, what problem is Pinfare even solving!?

Commercial potential

I felt that their assessment of Pinfare’s commercial potential was shallow.

Firstly, they mentioned that there were a “staggering 3.8 billion air travellers” but failed to acknowledge that they were not all potential target customers - for instance, how about travellers who already know that they have to travel on a certain date? They don’t need their price hedging service!

Secondly, as a VC, I need to know whether their business model actually works, rather than just how big the “potential market” is.

They did not share any findings about how many customers they currently have, nor how much did they spend on acquiring their users.

The latter is especially important, because I need to know if they are able to churn a profit by providing this service. And if they are not currently making a profit, why? And do they have any plans to counter this? For instance, they could be incurring losses in their initial phase to acquire customers rapidly. None of this vital information was shared!

What do they have over airlines?

There is nothing stopping airlines from offering a service to lock in their airfare prices for a fee. In fact, airlines like American Airlines, Hawaiian Airlines and Virgin Atlantic are already offering this service!

[These travel brands let you lock in airline fares for up to a week](https://www.usatoday.com/story/travel/roadwarriorvoices/2015/12/29/these-travel-brands-let-you-lock-in-airline-fares-for-up-to-a-week/83279290/)

According to the presenters, Pinfare’s advantage is that they allow you to hedge the prices against multiple flights from multiple carriers.

This is a valid point. However, they failed to acknowledge that the airlines also had their own loyalty programs that potentially garners bigger savings than preventing the fluctuation in air fares would have.

Furthermore, airlines like Singapore Airlines, Air Canada, ANA, Lufthansa, just to name a few, *are already part of cross-carrier strategic partnerships like Star Alliance*. What’s to stop them from leveraging on their existing relationships to offer a similar price hedging service across their member carriers?

[Singapore Airlines - Star Alliance](https://www.singaporeair.com/en_UK/sg/travel-info/partner-airlines/star-alliance/)

Potential similar applications of Pinfare’s price hedging business model

As a VC, I would be terribly upset with the presenters and *cast serious doubt on their ability to innovate* for suggesting other potential business models that Pinfare is already doing!

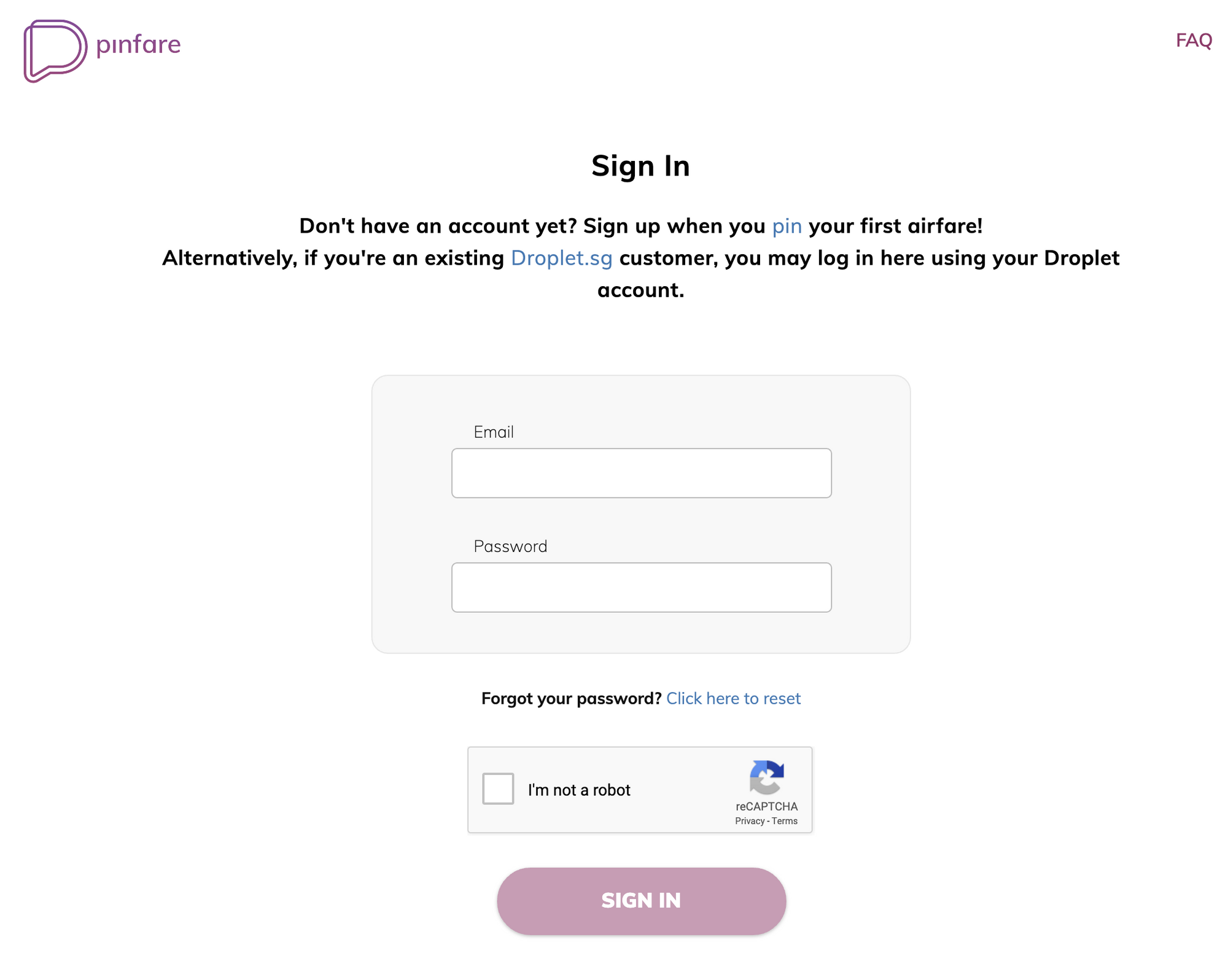

Specifically, their suggested improvement of Pinfare x Grab already exists - Droplet.sg

Pinfare’s sign in page literally even states that!

[NTUC Income launches Pinfare: Hedge yourself against airfare fluctuations | The MileLion](https://milelion.com/2019/04/03/ntuc-income-launches-pinfare-hedge-yourself-against-airfare-fluctuations/)

[NTUC Income launches Droplet - insurance plan to shield Grab customers from surge pricing when it rains, Banking News & Top Stories - The Straits Times](https://www.straitstimes.com/business/banking/ntuc-income-launches-droplet-insurance-plan-to-shield-grab-customers-from-surge)

Presentation comments

Aside from the points that I have raised above about the presenters’ presentation. I also felt that their delivery of the presentation was lacking.

Specifically, I felt that their user stories were not relatable.

I have personally never encountered the scenario where the price of my air ticket fluctuated way above my budget because I am usually a decisive buyer. I also frequently prefer to travel alone.

I found their tagline of “Save money, get inspired” to lack PUNCH - as I wasn’t convinced that being able to prevent air fare fluctuations save me money compared to say, being inspired to not travel at all?

I also felt that it was completely unnecessary to mention about the tech stack.